The structure of Exness’s minimum deposit policy is designed to accommodate traders with various financial capabilities and trading strategies. This approach not only democratizes access to global financial markets but also aligns with Exness’s commitment to providing transparent, fair trading conditions. By offering a low entry threshold, Exness enables newcomers to the trading scene to experiment and learn without the pressure of a significant initial investment. Furthermore, the varying levels of minimum deposits across different account types reflect Exness’s understanding of the diverse needs and risk tolerances within its trading community, thus fostering a more inclusive trading environment.

What is Exness Minimum Deposit?

A minimum deposit is the smallest amount of money that an individual is required to deposit to open a new account with a financial institution, brokerage firm, or trading platform. This requirement can vary widely depending on the company and the type of account being opened. The minimum deposit can range from as low as $1 to $10. In the context of banking, it refers to the least amount needed to establish a bank account, while in trading or investing, it pertains to the minimum initial capital required to start trading or investing.

Minimum deposits are important for several reasons:

- Accessibility: They determine the entry barrier for new clients. A low minimum deposit makes it easier for individuals to access financial services, trading platforms, or investment opportunities without needing a significant initial capital.

- Client Segmentation: Financial institutions and brokers may use different minimum deposit levels to segment their clients into categories, offering various services, benefits, or account types based on the amount of capital a client is willing to commit.

- Operational Costs: For the service provider, the minimum deposit can help offset the costs associated with maintaining an account, ensuring that it is economically viable to offer services to the client.

- Risk Management: For traders and investors, the minimum deposit requirement can also serve as a risk management tool, as it forces consideration of how much capital they are willing or able to risk in the market.

Exness Minimum Deposit Requirements

Exness offers a range of account types with varying minimum deposit requirements, tailored to suit a variety of traders. These options include the Standard Account, various types of Professional Accounts (such as Raw Spread, Zero, and Pro accounts), and specialized accounts for specific trading strategies or volumes. The minimum deposit amount varies depending on the chosen account type and the trader’s region.

The Standard Account, designed to be accessible to a wide audience including beginners, often features a very low minimum deposit requirement, sometimes as low as $1 or equivalent in other currencies. This low entry barrier enables new traders to start trading without a significant financial commitment.

Professional Accounts, targeted at experienced traders who need advanced features such as lower spreads and leverage options, may have higher minimum deposit requirements. These accounts are structured to meet the needs of serious traders seeking optimal trading conditions and can range from a few hundred to several thousand dollars.

Benefits of Exness Minimum Deposit

The minimum deposit requirement set by Exness offers several benefits, making it an attractive choice for a wide range of traders. Here are some of the key advantages:

- Accessibility for Beginners: By setting a low minimum deposit for certain account types, Exness opens the door for novice traders to enter the forex and CFD markets without the need for a substantial initial investment. This accessibility encourages more individuals to explore trading opportunities, learn about financial markets, and develop trading skills with a lower financial risk.

- Flexibility for Various Trading Strategies: Exness offers different account types with varying minimum deposit requirements, providing traders the flexibility to choose an account that best fits their trading strategy, risk tolerance, and financial capacity. Whether a trader prefers high-volume trading with tighter spreads or is just looking to experiment with small transactions, there’s likely an account type that suits their needs.

- Risk Management: For many, the prospect of trading involves significant risk, particularly for those who are new to the markets. A low minimum deposit requirement allows traders to manage their risk more effectively by limiting the amount of capital at risk while they gain experience and refine their strategies.

- Opportunity to Test the Platform: A minimal initial deposit requirement provides a low-cost opportunity for traders to test Exness’s trading platform, execution speed, and customer service without committing a large amount of money upfront. This “try before you buy” approach can be crucial for traders in deciding if Exness is the right broker for their trading journey.

- Encourages Gradual Investment Scaling: Traders can start with a small deposit and gradually increase their investment as they become more confident in their trading abilities and strategies. This approach allows for a more cautious and considered investment strategy, minimizing potential losses as traders learn the ropes.

- Global Market Access: Even with a minimal deposit, traders gain access to a wide range of markets offered by Exness, including forex pairs, cryptocurrencies, metals, indices, and energies. This diversity enables traders to experiment with various asset classes and find the ones that best align with their interests and market insights.

How Start with Exness Minimum Deposit

Starting with Exness and making your minimum deposit involves a straightforward process, designed to be user-friendly and accessible for traders at all levels. Here’s a step-by-step guide to get you started.

Step 1: Research

- Understand Account Types: Before signing up, research the different account types Exness offers. Each account has unique features, benefits, and minimum deposit requirements suited to various trading styles and experience levels.

- Review Terms and Conditions: Familiarize yourself with the trading conditions, fees, spreads, and leverage options associated with each account type.

Step 2: Sign Up

- Create an Account: Visit the Exness website and click on the “Open an Account” button. You’ll be prompted to enter your email address and set a password, or you can sign up using an existing Google or Facebook account.

- Complete the Registration: Fill in the required personal details, including your full name, date of birth, and contact information. You may also be asked to choose your account type during this step.

Step 3: Verification

- Verify Your Identity: To comply with financial regulations, Exness requires you to verify your identity and residence. This typically involves uploading copies of your government-issued ID (such as a passport or driver’s license) and a recent utility bill or bank statement showing your address.

- Wait for Approval: Your documents will be reviewed by Exness, a process that can take from a few hours to a couple of days. Once verified, you’ll receive confirmation, and your account will be fully activated.

Step 4: Making the Minimum Deposit

- Log In: Once your account is set up and verified, log in to your Exness personal area.

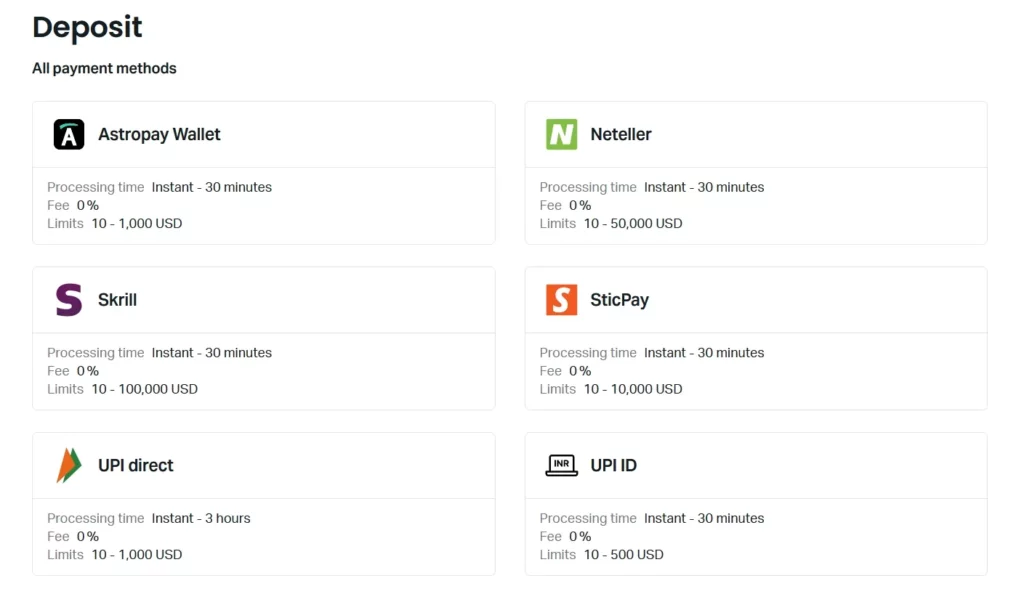

- Select Deposit Option: Navigate to the deposit section and choose your preferred deposit method. Exness supports a variety of payment methods, including bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller.

- Enter Deposit Amount: Input the amount you wish to deposit. Ensure it meets or exceeds the minimum deposit requirement for your selected account type.

- Confirm the Transaction: Follow the prompts to confirm your deposit. The processing time can vary depending on the payment method chosen.

Step 5: Start Trading

- Access the Trading Platform: Once your deposit is processed, you can access the trading platform using the details provided by Exness. You might choose between different platforms like MetaTrader 4 or MetaTrader 5, depending on your account type and personal preference.

- Begin Trading: With your account funded, you’re now ready to start trading. Consider starting with demo trades or small positions to familiarize yourself with the platform and markets.

Additional Tips

- Leverage Educational Resources: Make use of Exness’s educational materials, tutorials, and demo accounts to build your trading knowledge and skills.

- Practice Responsible Trading: Implement risk management strategies, and remember that trading involves the risk of loss.

Tips for Managing Minimum Deposit

Managing your minimum deposit effectively is crucial for a successful trading journey, especially when starting with a small initial investment. Here are several tips to help you make the most of your minimum deposit:

- Start with a Trading Plan: Before you begin trading, develop a clear trading plan. This should include your trading goals, risk tolerance, strategy, and criteria for entering and exiting trades. A well-thought-out plan helps you trade systematically rather than emotionally.

- Leverage Educational Resources: Take advantage of any educational resources provided by your broker. Understanding market analysis, trading strategies, and the mechanics of trading can significantly improve your chances of success.

- Practice with a Demo Account: If available, use a demo account to practice your trading strategies without any financial risk. This experience is invaluable for gaining confidence and understanding the market dynamics before using your real funds.

- Utilize Risk Management Tools: Employ risk management strategies to protect your capital. This includes setting stop-loss orders to minimize potential losses and taking profits at predetermined levels to secure gains.

- Start Small: Even if your broker allows for larger trades, start with small positions to minimize risk. This approach allows you to gain experience and insights into market movements without jeopardizing your entire deposit.

- Monitor Your Trades and Adjust: Regularly review your trading performance and adjust your strategies as necessary. Learning from both successes and failures is key to becoming a more effective trader.

- Keep an Eye on Trading Costs: Be aware of all trading costs, including spreads, commissions, and swap fees. These can eat into your profits, especially when trading with a small deposit. Optimize your trades to minimize these costs.

- Diversify Wisely: While diversification can spread risk, overly diversifying with a minimum deposit might limit potential gains. Focus on a few well-chosen investments that you’ve researched thoroughly.

- Stay Updated on Market Conditions: Market conditions can change rapidly. Stay informed about global economic indicators, news events, and trends that can impact the markets you are trading in.

- Know When to Stop: Set daily or weekly loss limits to protect your capital. If you hit this limit, take a break to reassess your strategy and mindset before trading again.

Conclusion

The minimum deposit feature offered by Exness represents a crucial element in the broker’s commitment to making forex and CFD trading accessible to a broad audience. This approach aligns with the company’s mission to democratize trading, allowing individuals from various financial backgrounds to participate in the global markets. Exness’s strategy of offering low minimum deposits, especially for standard accounts, ensures that new traders can embark on their trading journeys with minimal initial investment, thus lowering the entry barrier to the highly competitive trading environment.

The flexibility in minimum deposit requirements across different account types caters to both novice and experienced traders, enabling them to select an account that best matches their trading style, risk tolerance, and financial capabilities. This tiered structure allows traders to scale their activities in accordance with their growth in experience and capital, providing pathways for progression from beginner to more advanced trading levels.

FAQ for Exness Minimum Deposit

What is the minimum deposit required to open an account with Exness?

The minimum deposit required at Exness varies by account type. For Standard Accounts, the minimum deposit is often very low, sometimes as little as $1, making it highly accessible for beginners. Professional accounts might require higher deposits, tailored to experienced traders seeking advanced features.