- How to Make Money with Exness in Nigeria?

- How Long Does Exness Withdrawal Take in Nigeria?

- How to Change Leverage on Exness for Nigerian Users?

- How to Open an Exness Account in Nigeria?

- Is Exness Legit in Nigeria?

- Is Exness Reliable for Nigerian Users?

- Who Owns Exness?

- Can I Trade on an Unverified Exness Account in Nigeria?

- How Much is Exness Spread and Commission for Nigerian Users?

- How to Deposit Currency to Exness in Nigeria?

- How to Include Servers in Exness MetaTrader?

- How to Login to Exness in Nigeria?

- How to Access the Exness YouTube Channel?

- How to Open an Exness ECN Account?

- Is Exness Broker Regulated in Nigeria?

- Is Exness Forex Broker Legal in Nigeria?

- What is the Minimum Deposit for Nigerian Traders on Exness?

- Is There an Exness Office in Nigeria?

How to Make Money with Exness in Nigeria

Exness provides access to several financial markets:

- Forex

Trade currency pairs like USD/EUR. Profit from exchange rate fluctuations.

- Stocks

Trade CFDs on shares of companies such as Tesla or Apple. No actual share ownership.

- Indices

Trade market indices like the S&P 500 or NASDAQ. All Share Index, representing multiple stocks.

- Cryptocurrencies

Speculate on prices of digital currencies including Bitcoin and Ethereum.

- Commodities

Trade raw materials such as crude oil, gold, or agricultural products.

Trading involves risk. Learn and practice before investing real money. Always trade responsibly and stay informed about market trends and strategies.

How Long Does Exness Withdrawal Take in Nigeria?

The time required to process a withdrawal at Exness varies based on the payment method you use. Generally, withdrawals are processed within 1 to 5 business days. Here’s a breakdown: These usually offer faster processing times, often within a few hours to one business day.This method can take longer, typically between 3 to 5 business days, depending on your bank’s policies and processing times.

Remember, the exact duration may also be influenced by your bank or payment provider’s internal procedures. Always check with them for more precise information.

How to Change Leverage on Exness for Nigerian Users

Many Nigerian traders on Exness ask about adjusting leverage. Leverage impacts how much you can trade with your capital. Here’s a simple guide to change it:

- Log into your Exness account.

- Go to “Account Overview”.

- Pick the trading account you want to change.

- Find “Change Leverage” in account settings.

- Choose your preferred leverage level from the options.

- Confirm the change. It takes effect right away.

Leverage is like a loan from Exness. With 1:100 leverage, you control $100 for every $1 you have. This can boost profits, but also losses. Higher leverage means higher risk.

Tips for Nigerian Traders:

- Start with lower leverage until you’re comfortable.

- Higher leverage isn’t always better. It can wipe out your account faster.

- Use Exness’s free webinars and articles to learn more about leverage.

Remember, smart use of leverage can help. But it’s not a shortcut to riches. Always trade within your means and understanding.

Exness wants Nigerian traders to succeed. That’s why they offer these tools. Use them wisely to grow your trading skills and account balance.

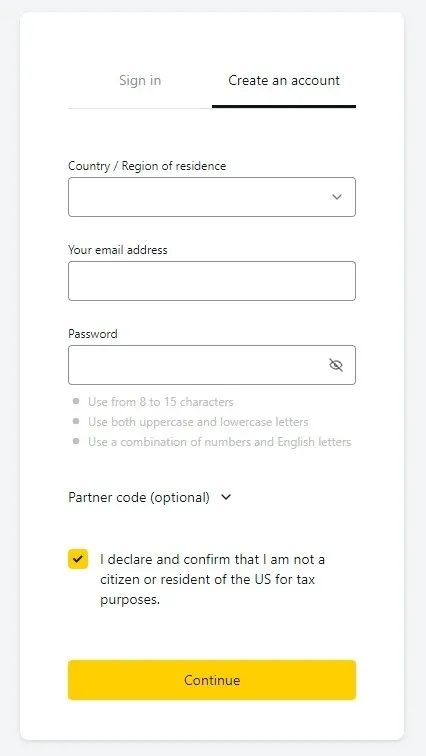

How to Open an Exness Account in Nigeria

Many Nigerians want to trade with Exness. Good news: starting is simple. Here’s how:

- Go to Exness.com. Click “Open Account”.

- Fill in your details. Choose your account type (Standard, Raw Spread, or Zero).

- Check your email. Click the link Exness sends to verify.

- Prove it’s you. Upload your Nigerian ID, passport, or driver’s license.

- Add money. Use bank transfer, cards, or e-wallets. Then start trading.

Helpful Tips:

- Use your real email and phone. Exness might need these for security.

- Have your ID ready. Clear, recent photos make verification faster.

- Watch Exness videos or read guides. They help you trade smarter.

That’s it! In no time, you’re set to trade forex, stocks, or more on Exness. Many Nigerians find it’s a smooth start to their trading journey.

Is Exness Legit in Nigeria?

Yes, Exness is a legitimate online forex broker with a solid reputation in the financial industry. Established in 2008, Exness is recognized for its transparency and adherence to regulations. The broker is regulated by respected financial authorities such as the Financial Conduct Authority (FCA) in the United Kingdom and the Cyprus Securities and Exchange Commission (CySEC).

- Regulatory Oversight: Exness operates under the strict supervision of reputable regulatory bodies, ensuring compliance with financial regulations.

- Client Fund Protection: Exness ensures the safety of client funds by segregating them from the company’s operational funds. They are also a member of compensation schemes, providing an extra layer of protection.

- Awards and Accolades: Over the years, Exness has received numerous awards, highlighting their commitment to quality services and innovative trading solutions.

Exness’s dedication to financial security and client protection, combined with its regulatory compliance and industry recognition, makes it a trustworthy choice for traders in Nigeria.

Is Exness Reliable for Nigerian Users?

Yes, Exness is a reliable forex broker with a solid track record, meeting the needs of a wide range of traders. It provides a vast selection of trading instruments such as currency pairs, commodities, indices, and cryptocurrencies. This variety allows traders to employ different strategies to suit their trading styles. With competitive spreads and low trading costs, Exness can potentially boost profitability for its users. The broker offers various account types tailored for both beginners and experienced traders, each with distinct features and leverage options. However, it’s crucial for traders to conduct their own research and consider their personal requirements, as trading in financial markets carries inherent risks. Overall, Exness has built a positive reputation and stands out as a reliable choice, but effective risk management is essential for successful trading.

Who Owns Exness?

The story starts in 2008 with two men: Petr Valov and Igor Lychagov. They started Exness and still own it privately. This means it’s not a public company you can buy shares in.

Exness works globally, so it follows rules in many places. Big watchdogs like CySEC in Cyprus and the FCA in the UK make sure Exness plays fair. This gives peace of mind to traders.

Can I Trade on an Unverified Exness Account in Nigeria?

Yes, Nigerian traders can use Exness without verifying. But should you? Probably not.

Here’s why:

- Unverified accounts have limits. You can’t move as much money in or out.

- Verified accounts are safer. Exness can protect you better if they know it’s really you.

- Some tools only work for verified accounts. You might miss out on things that help you trade better.

Verifying is easy. Just upload your ID. Then you get all the perks. Most Nigerian traders find it’s worth the small effort. Exness wants you to have the best tools, so they encourage verification.

In short, verify your Exness account. It’s a small step for a much better trading journey.

How Much is Exness Spread and Commission for Nigerian Users?

Spreads: This is the gap between buy and sell prices. Exness offers both fixed and floating spreads. Fixed means it doesn’t change; floating can vary with market conditions. Some accounts have spreads as low as 0.0 pips.

Commissions: Some Exness accounts charge a small fee per trade. Others don’t.

Which is best? It depends on how you trade. Fast, frequent trades? Low spreads matter more. Longer trades? Commissions might be your focus.

For exact numbers, check Exness.com or your trading platform. They show real-time spreads and fees. This helps you plan your trades better.

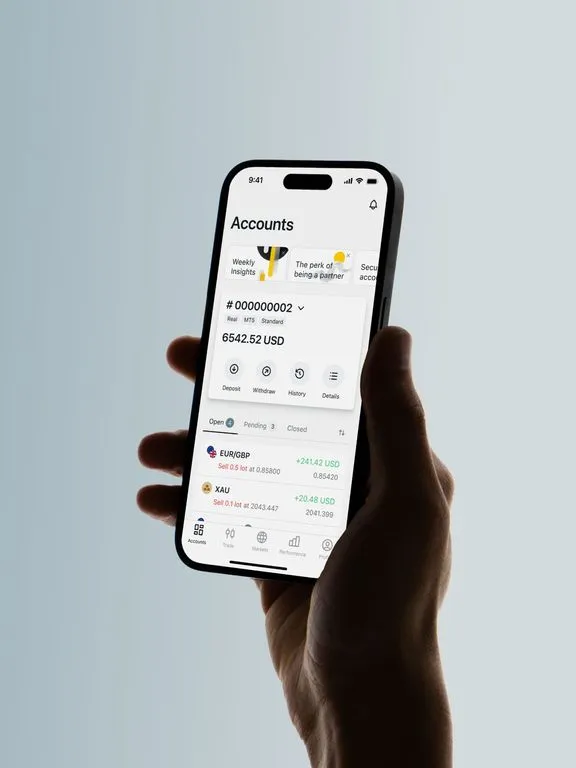

How to Deposit Currency to Exness in Nigeria?

If you want to deposit funds to your Exness profile in Nigeria, here are the easy procedures to follow:

- Log into Your Exness Account: Go to the Exness website at www.exness.com. Enter your registered email and password to sign in. If you are first-time to Exness, click on “Register” or “Sign Up” to create your profile.

- Find the “Deposit” Section: Once logged in, navigate to your profile dashboard or the main menu. Look for and click on the “Deposit” or “Funds” section to view the available deposit options.

- Pick Your Payment Method and Currency: Exness offers several deposit options such as credit/debit cards, bank transfers, e-wallets, and local payment options designed for Nigeria. Choose the method that is best suitable for you and select the currency for the deposit.

- Enter the Deposit Amount and Complete the Instructions: Enter the sum you want to deposit into your trading profile. Make sure to verify the minimum deposit requirements for your profile type. After entering the sum, follow the on-screen instructions to complete the process. Depending on your process method, you may be redirected to a secure payment gateway or asked for extra confirmation. Make sure all details are accurate to prevent any holdups.

How to Include Servers in Exness MetaTrader?

To connect Exness servers to your MetaTrader trading platform, make sure MetaTrader is already installed on your device. Once you’ve got it installed, follow these steps to connect to Exness servers:

- Launch MetaTrader: Open the MetaTrader app on your device.

- Login to Your Trading Account: Click on “File” in the top menu, then select “Login to Trade Account.” This will bring up a new login window.

- Enter Your Exness Details: In the login window, type in your Exness account number and password.

- Select the Exness Server: Pick the correct Exness server from the dropdown menu.

- Login to Connect: Click the “Login” button. If your details and server choice are correct, you’ll successfully log into your Exness MetaTrader account.

- Adjust Leverage if Needed: If you need to, find the “Change Leverage” option in the account settings or details section to make adjustments.

Once you’re logged in, you’ll have full access to your trading account and can start trading various financial instruments on the MetaTrader platform.

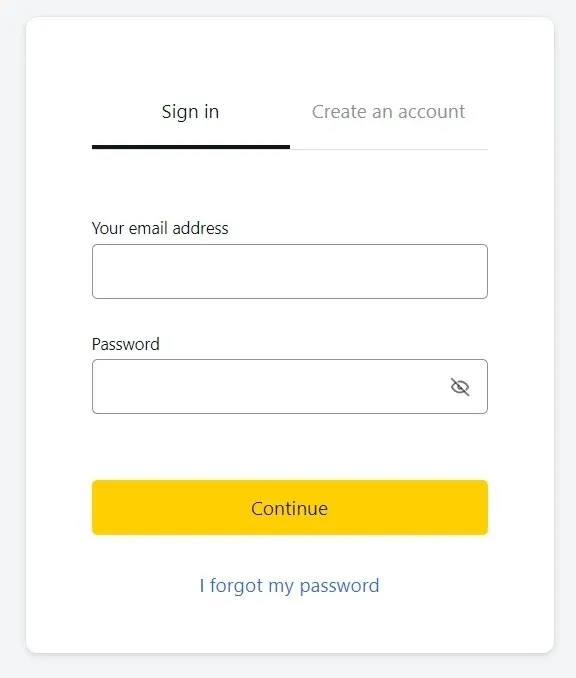

How to Login to Exness in Nigeria

Sign in to your Exness account easily and fast. Do this to reach your trading account:

- Start Your Browser: Open your web browser on your PC or phone. Make sure you have a good internet connection.

- Go to Exness Site: Type “exness.com” in your browser’s bar and press Enter to visit Exness site.

- Tap “Login” Button: Find “Login” at the top-right of the site and tap it.

- Enter Your Info: Put your account number or email linked to your Exness account, plus the password you used while signing up.

- Solve CAPTCHA (if asked): For safety, Exness might ask you to finish a CAPTCHA to verify you are not a bot. Finish it as directed.

- Click “Login”: After adding your info and solving CAPTCHA (if asked), hit “Login” to go ahead.

- Get into Your Account: If your login details are right, you will see your Exness account. Here, you can see your trading account, do transactions, check your trade history, and handle other account tasks.

- Log Out When Done: Always log out of your Exness account when you finish trading or other account tasks. This keeps your account and info safe.

How to Access the Exness YouTube Channel

Exness, a leading online trading platform, has an educational YouTube channel packed with resources to help you navigate their platform. To find their official channel, simply search for “Exness” on YouTube. The channel offers a variety of tutorials, including step-by-step guides on logging in and using their trading tools. These videos are designed to be easy to follow, whether you are a beginner or an experienced trader. You will also find valuable content on market analysis, trading strategies, and educational materials to boost your trading skills.

By subscribing to the Exness YouTube channel, you can stay updated with the latest videos and enhance your trading knowledge with expert insights and practical tips.

How to Open an Exness ECN Account

It’s easy for people from Nigeria to make an ECN account with Exness. Here are the simple steps:

- Sign in or join: Log in to your Exness account or make a new one.

- Find Accounts: Go to “Accounts” in your Exness dashboard.

- Choose ECN Account: Pick “ECN” for the account type you want.

- Give Information and Papers: Fill in needed info and upload necessary papers for checking.

- Get Account Approval and Add Money: When your account is okayed, you can add money and start trading on your ECN account.

With these steps, you can fast set up your ECN account and start trading with Exness, using their good trading tools and fair terms.

Is Exness Broker Regulated in Nigeria?

Yes, Exness is a regulated broker. It is overseen by the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies ensure that Exness complies with stringent financial regulations, offering protection and peace of mind to traders.

Is Exness Forex Broker Legal in Nigeria?

Yes, Exness is a legal and reliable option for forex trading in Nigeria. It is a globally recognized broker, regulated by respected authorities like CySEC and the FCA. While Exness is well-regulated, Nigerian traders should stay informed about local forex regulations to ensure they are trading within the law.

Who Owns Exness?

The ownership details of Exness are not publicly disclosed. However, Exness has established itself as a global brokerage firm, offering trading services and investment opportunities worldwide. The company adheres to regulatory standards and maintains a solid reputation in the financial industry.

What is the Minimum Deposit for Nigerian Traders on Exness?

The minimum deposit at which you can open an Exness account may vary depending on the type of account and the payment method you select. STANDARD: You can begin trading with $1 on Standard accounts. However, Pro accounts usually demand a much higher minimum claim size, often beginning at $200.

You will have to deposit a little extra from the minimum unique you to pay if both are not accepted. Depending on your payment method, some minimum deposit limits at Mr Slotmay vary with additional transaction fees – this will be advertised when applicable. As such, it is important for traders at Exness to first consider the details of the own deposit types and payment methods and to confirm the minimum deposit once registered.

Is There an Exness Office in Nigeria?

Currently, Exness does not have a local office in Nigeria.

However, Exness operates from several global locations, including:

- Cyprus: 1, Siafi Street, Porto Bello, Office 401, Limassol

- United Kingdom: 107 Cheapside, London

- Seychelles: 9A CT House, 2nd Floor, Providence, Mahe

- South Africa: Offices 307&308, Third Floor, North Wing, Granger Bay Court, V&A Waterfront, Cape Town

- Curaçao: Emancipatie Boulevard Dominico F. “Don” Martina 31

- British Virgin Islands: Trinity Chambers, P.O. Box 4301, Road Town, Tortola

- Kenya: Courtyard, 2nd Floor, General Mathenge Road, Westlands, Nairobi

For Nigerian traders, Exness offers comprehensive online support and services, ensuring you can trade effectively without needing a local office.