For traders, the verification adds a layer of security to their investments and personal information, while for Exness, it ensures compliance with global regulatory standards, maintaining its reputation as a reliable and ethical trading platform. The verification process is tailored to be as efficient and user-friendly as possible, with Exness providing guidance and support throughout. Once completed, clients gain full access to the wide range of services offered by Exness, including various trading instruments, leverage options, and the ability to participate in global financial markets. This initial step is crucial for fostering a safe trading environment, promoting financial integrity, and building a lasting relationship between Exness and its clients.

Types of Verification at Exness

Exness employs a comprehensive verification process to ensure the security of its platform and to comply with regulatory standards. The verification at Exness can be categorized into several types, each serving a specific purpose in enhancing the trading environment’s safety and integrity. These types include:

- Identity Verification: This is the first and most fundamental step in the Exness verification process. Clients are required to provide a government-issued identification document, such as a passport, national ID card, or driver’s license. This step is crucial for confirming the client’s identity and is a standard requirement across the financial industry to prevent identity theft and fraud.

- Residence Verification: After identity verification, clients must prove their current address. This is typically achieved by submitting a utility bill, bank statement, or government-issued document that includes the client’s name and address, and is not older than three months. Residence verification helps in ensuring that the information provided is accurate and up to date, which is vital for regulatory and security purposes.

- Bank Account Verification: For clients who wish to perform transactions through bank transfers, verifying their bank account becomes necessary. This involves submitting documentation that confirms the ownership of the bank account being used for deposits and withdrawals. Bank account verification is important for preventing financial fraud and ensuring that funds are transferred to and from the correct accounts.

- Credit/Debit Card Verification: Similar to bank account verification, clients using credit or debit cards for transactions are required to verify these cards. This typically involves providing a copy of the front and back of the card, with sensitive information partially obscured. This step is crucial for preventing unauthorized use of cards and ensuring that transactions are securely processed.

- E-Wallet Verification: For clients who prefer using electronic wallets (e-wallets) for their transactions, verification of these accounts is also required. The specific documents needed can vary depending on the e-wallet service but generally include screenshots of the e-wallet account showing the client’s personal details. E-wallet verification ensures that the account is legitimately owned by the client and is in good standing.

- Additional Verification: In certain cases, Exness may request additional documents or information from clients. This can include source of funds documents, source of wealth documents, or additional proof of identity or residence. These requests are typically made to comply with enhanced due diligence requirements or if there is a specific concern regarding a client’s account or activities.

Exness Verification Process

Completing the Exness verification process is straightforward, designed to secure your trading activities and comply with regulatory requirements. Here’s a step-by-step guide to navigate through the verification process:

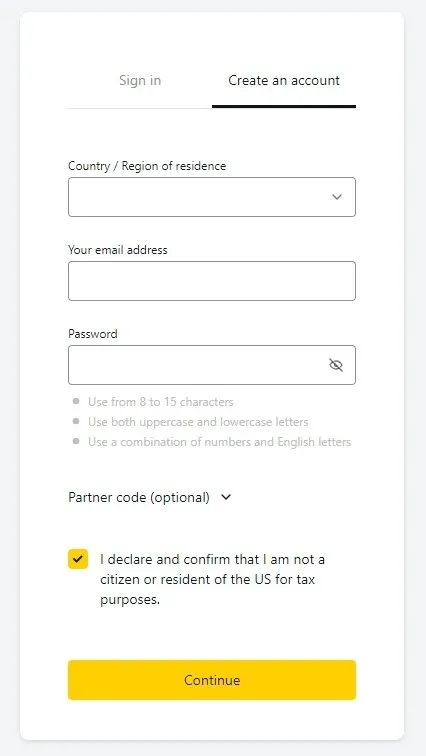

1. Sign Up and Access Your Profile

- Begin by registering an account on the Exness platform. You will need to provide some basic information such as your name, email address, and phone number.

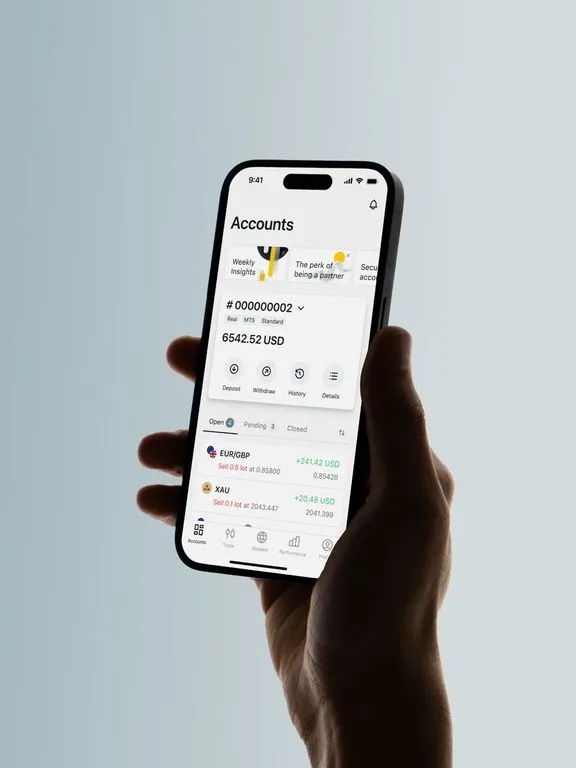

- Once your account is created, log in and access your personal area or account dashboard. This is where you will find the options for account verification.

2. Start the Identity Verification Process

- Navigate to the verification section of your account dashboard. The first step usually involves identity verification.

- Upload a clear, color copy of a government-issued identification document. This could be your passport, national ID card, or driver’s license. Make sure that all the information is visible and that the document is valid.

3. Complete Residence Verification

- After your identity has been verified, proceed to verify your residence. This typically involves submitting a document that proves your current address.

- Acceptable documents for residence verification include a utility bill, bank statement, or any official government correspondence. The document should not be more than three months old and must bear your name and address clearly.

4. Bank Account and Payment Method Verification

- If you plan to use bank transfers, credit/debit cards, or e-wallets for deposits and withdrawals, you might be required to verify these as well.

- For bank accounts, a bank statement or a screenshot of your online banking showing your name and account details may be required.

- For credit/debit cards, a picture of the card showing the name and the last four digits (with other details covered for security) is usually needed.

- E-wallet verification can involve providing a screenshot of your e-wallet profile page, showing your personal details.

5. Await Verification Approval

- Once all required documents are submitted, Exness will review them for compliance. This process may take a few days, depending on the volume of verifications being processed.

- Keep an eye on your email and Exness account notifications for any updates regarding your verification status or if additional information is needed.

6. Complete Additional Verification if Required

- In some cases, Exness may request further documentation or information for additional verification. This is usually to comply with more stringent regulatory requirements or if there’s a specific concern about the provided information.

- Respond promptly to any requests for additional verification to avoid delays in the approval process.

7. Verification Completion

- Once all the steps have been completed and your documents have been approved, your Exness account will be fully verified.

- You’ll then have access to all the features and services offered by Exness, including various trading instruments and platforms.

Benefits of Exness Account Verification

Exness Verification brings several significant benefits to traders, enhancing the security and functionality of their trading experience. This process, while necessary for compliance with regulatory standards, also offers advantages directly to the users:

Enhanced Security

The verification process helps protect your account from unauthorized access and fraudulent activities. By confirming your identity and residency, Exness ensures that only you have control over your account and financial transactions. This level of security is crucial in today’s digital age, where identity theft and financial fraud are prevalent risks.

Access to Full Trading Features

Only verified accounts can access all the trading features and tools that Exness offers. This includes a wider range of trading instruments, leverage options, and the ability to participate in more complex trading strategies. Verification removes restrictions on your account, allowing you to explore the full potential of the Exness trading platform.

Increased Deposit and Withdrawal Limits

Verified accounts typically enjoy higher deposit and withdrawal limits compared to unverified accounts. This is particularly beneficial for serious traders looking to operate with larger volumes. The ability to move funds more freely facilitates better management of your trading capital and strategies.

Faster Transactions

The verification process can also lead to faster processing of deposits and withdrawals. Verified accounts are pre-checked for compliance with anti-money laundering (AML) and know your customer (KYC) regulations, which can streamline transaction approvals and reduce waiting times.

Regulatory Compliance

By completing the Exness verification process, you’re participating in a system that adheres to international regulatory standards. This compliance is not only about following the law but also about ensuring the integrity and stability of the global financial market. It reflects well on Exness as a responsible platform and on you as a trader.

Improved Customer Support

Verified accounts may receive more personalized and swift customer support. Since the platform already has your verified information, it can expedite the resolution of any issues or questions you might have. This means less time dealing with support issues and more time focusing on trading.

Trust and Credibility

Having a verified account can enhance your credibility among other traders and institutions. In situations where you might engage in partnerships or other collaborative financial activities, having verified status can serve as a badge of trustworthiness.

Market Access

Certain markets and trading instruments might have restrictions that only allow participation from verified traders. Verification opens up these opportunities, allowing you to diversify your trading strategies across different markets and instruments.

Tips for Successful Verification on Exness

Successfully completing the verification process on Exness, or any trading platform, is crucial for accessing all the services and ensuring a smooth trading experience. Here are some tips to help you navigate the Exness verification process successfully:

Prepare Your Documents in Advance

- Make sure you have all the necessary documents before starting the verification process. This includes a valid government-issued ID (passport, national ID card, or driver’s license) and a recent utility bill or bank statement for proof of address.

- Ensure that your documents are valid and have not expired.

Ensure Documents are Clear and Legible

- When scanning or photographing your documents, make sure the images are clear and all text is legible. Blurry or obscured information can lead to delays in the verification process.

- Check that no part of the document is cut off and that the entire document is visible in the photo or scan.

Follow Specific Requirements for Document Submission

- Pay attention to any specific requirements for documents, such as the need for color images or the requirement to hide certain card details for credit/debit card verification.

- If submitting a bank statement or utility bill, ensure it’s dated within the last three months to be considered valid.

Provide Accurate Information

- When registering your account, ensure that all information provided matches the details on your identification and residence documents. Discrepancies between your account information and your documents can cause delays or rejections.

Respond Promptly to Requests for Additional Information

- If Exness requests additional information or documents, respond as quickly as possible. Delays in responding can prolong the verification process.

- Check your email and account notifications regularly for any updates or requests from Exness.

Use High-Quality Images

- Use a good-quality camera or scanner to capture images of your documents. High-quality images reduce the risk of rejection due to unreadable or unclear information.

Understand the Requirements for Each Verification Type

- Familiarize yourself with the requirements for each type of verification (identity, residence, bank account, etc.) to ensure you provide all necessary information and documents in the correct format.

Keep Your Information Updated

- If any of your personal information changes (e.g., address, phone number), update your Exness profile accordingly and be prepared to provide documentation for the new information.

Use the Help Resources

- Exness provides guidance and resources on their website to help with the verification process. Don’t hesitate to use these resources if you’re unsure about any step or requirement.

Contact Support if Needed

- If you encounter any issues during the verification process, or if you have questions about specific requirements, contact Exness support for assistance. They can provide clarification and help resolve any problems.

Conclusion

Successfully navigating the Exness verification process is a fundamental step for traders aiming to utilize the full spectrum of services offered by the platform. By adhering to the verification requirements, traders not only ensure compliance with international regulatory standards but also significantly enhance the security and integrity of their trading activities. The verification process, which includes steps for confirming identity, residence, and payment methods, is designed to protect both the trader and the platform from fraudulent activities and to maintain a trustworthy trading environment.

The benefits of completing the verification process are manifold, ranging from increased account security and access to a wider array of trading features to higher transaction limits and faster processing times. It underscores Exness’s commitment to providing a secure, compliant, and user-friendly trading experience. Moreover, the tips provided for successful verification emphasize the importance of preparation, accuracy, and responsiveness, which are key to a smooth verification experience.

FAQ for Exness Verification

How long does the verification process take?

The verification process typically takes a few business days. However, it may vary depending on the volume of verification applications Exness is processing. Ensure your documents are clear and follow the guidelines to avoid delays.